NOTICE OF PROPERTY TAX INCREASE

The City of Smyrna has tentatively adopted a millage rate which will require an increase in property taxes by 11.70 percent.

All concerned citizens are invited to the public hearing on this tax increase to be held at 2800 King Street SE, Smyrna, Georgia, Smyrna City Hall Council Chambers on July 18, 2022 at 7:00 PM.

Times and places of additional public hearings on this tax increase are at 2800 King Street SE, Smyrna, Georgia, Smyrna City Hall Council Chambers on August 1, 2022 at 10:00 AM and 6:45 PM.

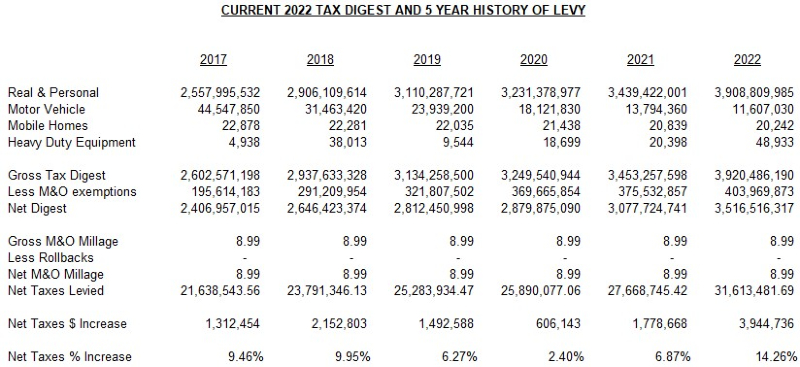

This tentative increase will result in a millage rate of 8.990 mills, an increase of 0.942 mills. Without this tentative tax increase, the millage rate will be no more than 8.048 mills. The proposed tax increase for a home with a fair market value of $375,000 is approximately $131.88 and the proposed tax increase for non-homestead property with a fair market value of $575,000 is approximately $216.66.

IMPORTANT ADDITIONAL INFORMATION NOTICE TO SMYRNA TAXPAYERS: THE CITY OF SMYRNA IS NOT INCREASING TAX RATES

According to Georgia Law, all taxing agencies must advertise a tax increase and hold three public hearings to claim taxes on reassessed properties, even if the millage rate remains unchanged as in the case of Smyrna. The City of Smyrna has tentatively adopted a millage rate equal to last year’s millage rate of 8.99. The millage rate is not being increased in The City of Smyrna. The tax rate will be the same for 2022 as it was in 2021.